Hello and welcome to five-year Club video number 107. I'm going to talk about non-deductible IRA contributions and a tax form, form 8606, that you need to be filling out. I have messed up on this in the past, and I know many others have as well. So, I'm going to give you the rundown so that you don't make the same mistake. Let's back up for a second and review IRAs. IRA stands for individual retirement arrangement. Generally speaking, it is a tax-sheltered retirement account with a yearly contribution limit of $5,500. If you qualify and are beyond a certain age (above 55), you can contribute up to $6,500 as a catch-up contribution. There are two flavors of the IRA: the Roth IRA and the traditional IRA. The Roth IRA is a post-tax flavor, meaning you contribute money that you've already paid taxes on. This money grows tax-free, and you can withdraw it tax-free when you retire after age 59 and a half. On the other hand, the traditional IRA is pre-tax money. Some people can take a deduction on their taxes for their contributions. However, when you withdraw the money in retirement, you will have to pay taxes on those withdrawals. If you are a high-income person in California, you may not qualify for the Roth IRA due to income limits. In that case, you might want to contribute to a traditional IRA and pay taxes later in your life when you live in a state with no state income tax, like Texas. Now, let's get into the nitty-gritty details. If you are not covered by an employer-sponsored retirement plan like a 403 B or a 401 K, you can deduct the traditional IRA from your taxes. In my case, I was able to deduct it because I wasn't covered by an...

Award-winning PDF software

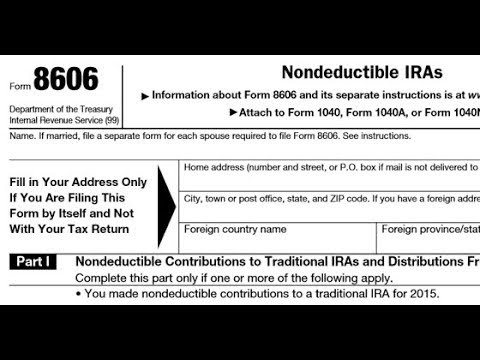

8606 example Form: What You Should Know

In 2017, Katelyn's total contributions to her Roth or traditional IRA were 30,000 at a combined annual tax rate of 31.5%. IRS Form 8606: When is Form 8606 Required for Retirement Plans? IRS Form 8606: When is Form 8606 Required for Traditional IRAs? IRS Form 8606, Nondeductible IRA Contributions, 2017 This form must be included with your 2025 tax return if any contribution to a new traditional IRA (or annuity contract) occurs during the tax year. Example. You are single, covered by an employer retirement plan, and you contributed 4,000 to a new Roth IRA on June 16, 2018. On December 29, 2018, you also made a 4,000 contribution to a new SEP IRA. If you make a contribution to a new SEP IRA on or before its due date (April 15) on or after December 29, 2018, no contribution to a new Roth IRA has occurred. Example. You are single, covered by an employer retirement plan, and you contribute 4,000 to a new Roth IRA on June 16, 2017. On December 29, 2018, you also made a 1,000 contribution to a new SEP IRA. If you make a contribution to a new SEP IRA on or before its due date (April 15) on or after December 29, 2018, no contribution has occurred. IRS Form 8606: When is Form 8606 Required for SEP or SIMPLE IRAs? IRS Form 8606: When is Form 8606 Required for Roth IRAs? Example: If your employer allows employees to contribute to their Roth IRAs, but you do not, then you must report contributions made to your traditional IRA or taxable distributions from the IRA to the following year. Example: In 2025 you contributed 4,000 to your traditional IRA. On March 4, 2018, you contributed 4,000 to your new Roth IRA as well you were also required to file a Form 1099-R for 5,000. If you make the contribution from your IRA in 2020, you were required in 2025 to report your traditional IRA contributions from 2017, so you credited them to a new Roth IRA. In 2020, you also made a taxable distribution from your IRA and reported the full amount.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8606, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8606 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8606 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8606 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8606 example