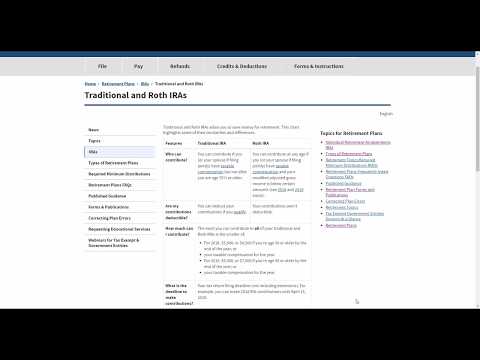

Good morning, everyone! Today, we're going to discuss traditional and Roth IRAs in a quick two-minute tax topic video. Before we begin, please hit the subscribe button to support our channel. Now, let's dive into the differences between traditional and Roth IRAs. One major difference is the deductibility of contributions. With a Roth IRA, your contributions are not deductible, while with a traditional IRA, they might be deductible. However, if you have an employer's retirement plan and earn a certain amount, you may not be able to deduct all contributions. In 2018, the contribution limit is $5,500 or $6,500, depending on your age. In 2019, it increases to $6,000 or $7,000 for individuals above a certain age. Next, let's discuss taxable distributions. In a Roth IRA, qualified distributions are tax-free. However, if you fail to meet certain requirements, your distributions may be taxed. Additionally, there could be a 10% early withdrawal penalty. So, it's important to be aware of these factors before drawing money from your account. That concludes our two-minute video on traditional and Roth IRAs. If you have any further questions, feel free to ask. Thank you for watching.

Award-winning PDF software

Irs 8606 2025 Form: What You Should Know

Nondeductible IRA distributions from IRAs in transition to a Roth IRA, if you have A conversion to a Roth IRA by your spouse. Non-deductible expenses that were claimed but should have been paid on an amended return. Examples: — Any non-cash amount for meals served in a restaurant you attended for more than 30 Oct 4, 2025 – Dec 7, 2025 — (filed 6/6/17) 2016 Results — 1040 Line 16, line 15 of Schedule C, line 8 of Schedule E, line 9 of Schedule G, and line 28 of Schedule P. 2015 Results — 30-day period ending 6/2/16. 2014 Results — Line 2, line 9 of Schedule D. 5/30/16 — Attached is a copy of 2025 Form 5498. 2013 Results — Line 6, line 12 of Schedule D. 5/30/15 — Attached is a copy of 2025 Form 5498. 5/10/15 — Attached is a copy of form 6666. 2010 Results — Line 10, line 12 of Schedule D. 2009 Results — Line 24, line 29 of Schedule A. 2008 — Attached is a copy of Form 990.pdf 2006 (and earlier) Results — Line 4, line 13 of Schedule B. 2005 Results — 3/29/13. Award Report — Form W-2G.pdf, Line 31-43 and Schedule H-1B.pdf — Form W-2G, W-2G-EZ, S-4.pdf Attachment A — 2025 Form 1040X/W2G (with attached Forms W-2G & 709) 2010 (and earlier) Results — Line 4, line 12 of Schedule B. 2009 Results — Line 4, line 12 of Schedule C. Filed 5/30/15 — (filed 4/27/15) 2008 — Attached is a copy of Form 990.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8606, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8606 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8606 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8606 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 8606 2025