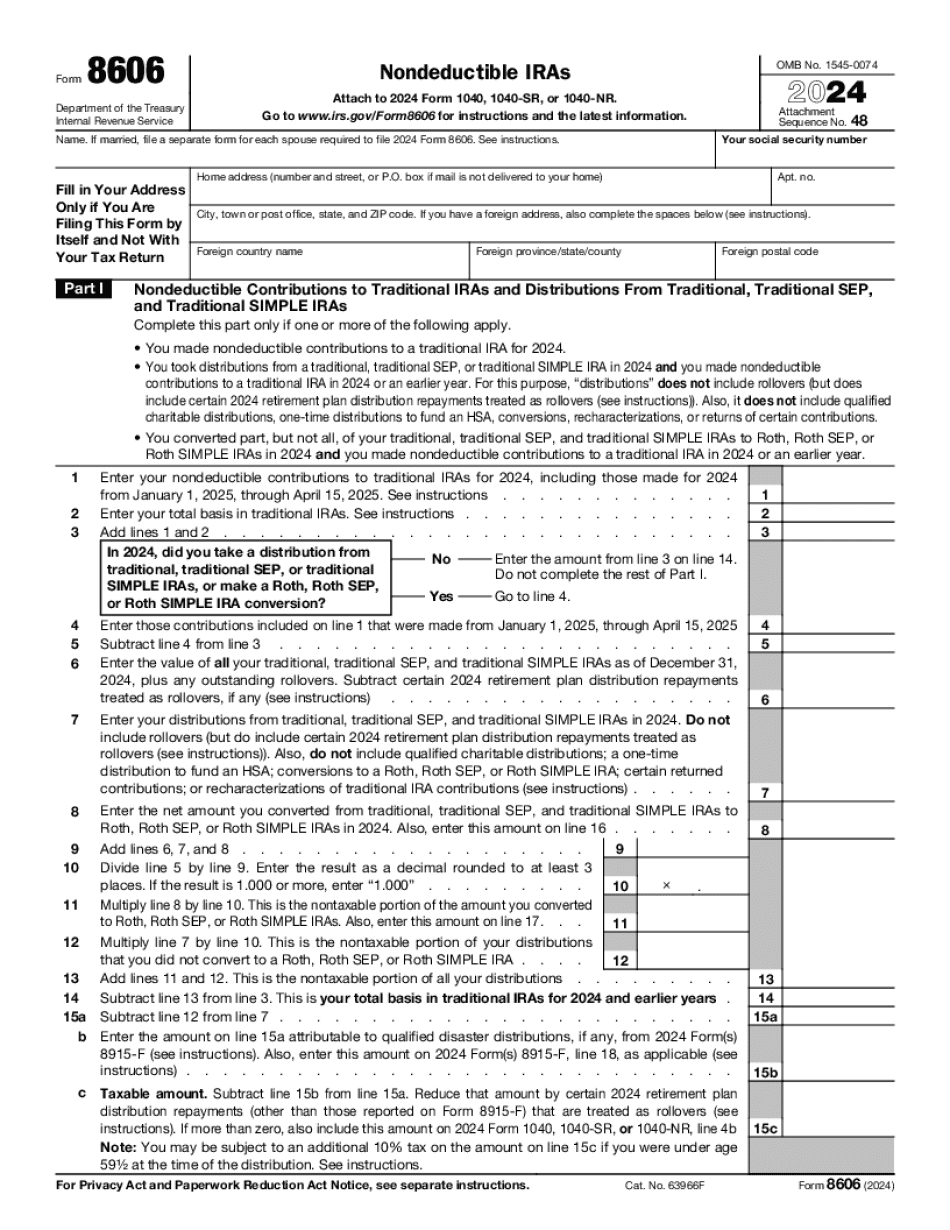

Laws dot-com legal forms guide form 80606 is a United States Internal Revenue Service tax form used to report any type of non-deductible IRA contributions throughout the tax year. Form 80606 can be obtained from the IRS website or from a local tax office. This form should be filed along with an individual 1040 tax return. At the top of the form, supply your name and social security number. Only fill out the contact information in the top if you are submitting this form for any other reason than with your annual tax return. Some reasons may include modifying a previously submitted form or for rollover purposes. In Part 1, you must supply a complete list of all non-deductible contributions to traditional IRAs and distributions from all traditional SCP and simple IRAs. Include the total amount of each contribution and deduction from your IRA account in the appropriate lines from line 1 to 14. You must calculate the correct amounts using the formulas provided. Once you have completed all calculations, enter your final taxable amount on line 15. This amount will be the basis for your tax on withdrawals. If during the tax year you converted any traditional SCP or simple IRA accounts into a Roth IRA, you must report this in Part 2. Enter the amount converted on line 16. Subtract this amount from your non-taxable portion. When completed, enter your taxable amount under the conversion on line 18. If you have received any distributions from Roth IRAs during the tax year, you must report this on Part 3 of the form 80606. From lines 19 to 35, calculate your Roth IRA distributions and use the calculations for each line to determine your total taxable amount. Enter this total amount on line 36. If you have received distributions from designated Roth IRA accounts,...

Award-winning PDF software

8606 turbotax Form: What You Should Know

IRS guidance. ▷ Go to (k)--IRS-403(b)-IRS-403(r) IRS Guidance — IRS Guidance — IRS Guidance and a Tip for Traditional IRA and Roth IRA Owners. Do you really think this is something for hobbyists? Here is yet another example of people who, when they are confronted with the complexity of their tax situation, say “Oh, well, that's too complicated, maybe I should do it all by hand? You people are horrible, don't make such things a priority, etc.” That's exactly what you should NOT want to be saying to yourself while doing your taxes. This isn't something to be considered “easy.” Even the simple act of filing a return and filling out a tax return can be complicated, but it is not impossible. Here is a tip from the National Foundation for Credit Counseling: If, when you are filling out your Form 8606 and other tax forms, you can't remember the form number, go to the IRS Website. See IRS Guide T2406 (page 2). It is easier to remember the amount of tax you paid than to guess the name of the section that you need to enter. If you get the amount wrong and end up paying more tax than originally thought, you will have to pay an additional tax. IRS has a good and detailed explanation of the rules of Form 8606 (page 4). You also should be aware that the IRS may require you to fill out a Form 8606 if you do not have a valid paper tax return that you mailed in. If your Form 8606 is valid, your accountant is responsible for making sure you file the correct form (Form 1024). It is illegal for your accountant to use your Form 8606 (for purposes other than filing it at the correct address) and report it to the IRS. Forms in your Turbo account will include their own form 8606 instructions. You may have to contact your accountant for these instructions. If you don't have your Form 8606 or can't find it, you can send a letter to Turbo Tax requesting an explanation of how you filled out the form. Don't be surprised if the reply says you have to print your Form 8606 and file it.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8606, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8606 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8606 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8606 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8606 turbotax