Award-winning PDF software

Filing 8606 for previous years Form: What You Should Know

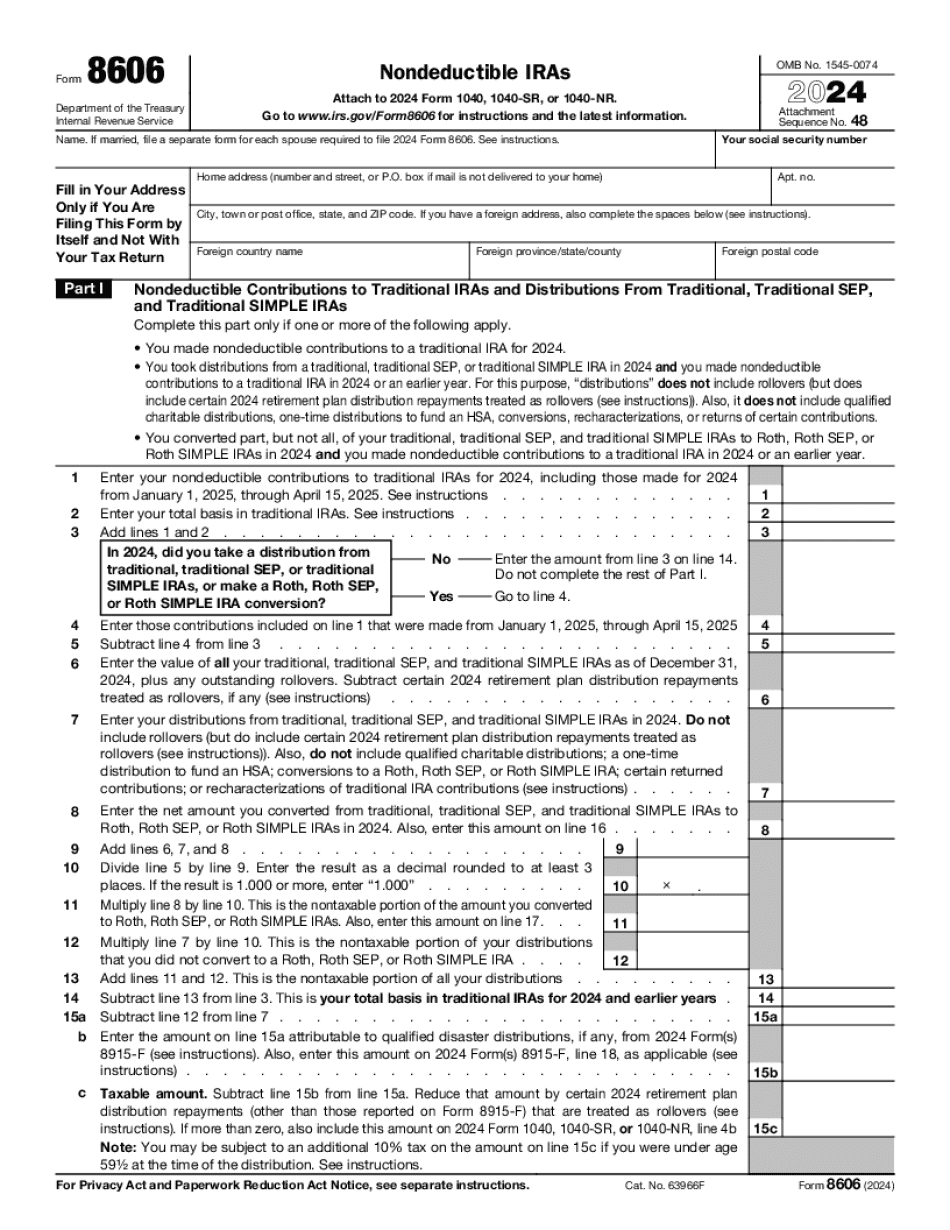

By filing Form 8606, you will be able to accurately report the prior year's basis. If the prior year's result is lower than the result of the current year, then you can file Form 8606 for the entire prior year and claim a reduction for the current year. This should only be completed if the prior year's result is less than or equal to the result in the current year. To get up to speed with the details, here's a helpful video: Form 8606: IRA Contribution Deduction May 5, 2025 — In 2016, the IRS took action against a former resident of Florida whose sole contribution was to buy a house—with a very high contribution limit of 3,000/year 100,000 (!)—and failed to properly report his contributions. The IRS took this person to court for double taxation. The result? The court reversed the decision and reinstated the maximum 3,000 contribution. The IRS is also considering revoking anyone's tax benefits who knowingly fails to correctly complete a prior-year Form 8606. This includes those who do nothing more than miss a deadline. It is important to know that if you do this, and you fail to properly file forms, you can be subject to tax liens and tax penalties. It also includes people who fail to file reports or do not file as late as one whole year after the required due date. When to file — Form 8606 is not supposed to be filed until you have received your IRA contribution limit, and you have actually put money on your IRA account each year since you have a qualifying high limit contribution. In order to avoid double taxation, you must have properly reported the contribution limit in the prior year so that when you file Form 8606, you will properly report the prior year's prior year's contributions. Tax Liens and Tax Penalties While an IRS judgment cannot be reversed or reduced by a court decision or a payment, a judgment can still be reduced if an individual fails to pay any part of the judgment. Even if you have correctly prepared your Form 8606 with the right prior-year basis information and your prior year's report is correct, if you fail to pay any part of the judgment to the IRS—as a result of failure to file, failure to file as late, non-filing, or withholding—your judgment will be reduced in full until you pay the entire debt to the IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8606, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8606 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8606 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8606 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.