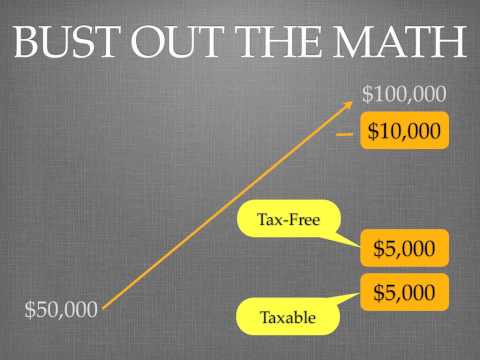

Hey there, this is Chuck Win from Win-Win Financial in Menomonee Falls. Today, I want to talk to you about non-deductible IRAs and how we can break it down in 90 seconds or less. First of all, let's do some math. Let's say you contribute $50,000 of non-deductible contributions into an IRA. Over time, that amount grows to a whopping $100,000. Now, let's assume you're over fifty-nine and a half and you decide to withdraw $10,000 from this account. How will the IRS tax you on that distribution? If it was a traditional IRA, the entire $10,000 would be taxable. On the other hand, if it was a Roth IRA, the entire $10,000 would be tax-free. However, since this is a non-deductible IRA, only half of the contribution is tax-deductible. This means that $5,000 will be received by you tax-free as a return of principal. The remaining $5,000 will be considered taxable. So if you withdraw $10,000, you will only need to pay tax on the $5,000 of taxable interest or gains. It's important to note that every year you contribute to a non-deductible IRA, you should fill out Form 8606 on the IRS website and include it in your tax return. This will serve as proof that you contributed on a non-tax-deductible basis. In summary, non-deductible IRAs can be a quick and viable alternative, especially if your income makes you ineligible for a Roth IRA. Remember, if you have any questions or need further assistance, feel free to reach out. Have a great day.

Award-winning PDF software

8606 2025 Form: What You Should Know

If you want the amount to be non-allocating, fill out your form again for your 2025 federal Form 1040, line 20. Note: When you change the amount from non-allocating to allocable, we use your 2025 federal Form 8606, line 19, to calculate your amount on line 20 on your 2025 Form 1099-INT. The 2025 federal Form 1099-INT form may differ from your 2025 federal Form 1040, 2025 Form 1040A, 2025 Form 1040NR, or 2025 Form 1098-B, 2025 Form 1098-EZ, or 2025 Form 1086S. Don't forget to attach the new Form 1099-INT to your 2025 federal Form 1040, 2025 Form 1040A, 2025 Form 1040NR, or 2025 Form 1040. The number on the front of the 2025 federal Form 1099-INT is the tax liability and amount of the refund; The total amount on line 21 of the 2025 federal Form 1099-INT is equal to the amount of the federal income tax that would have to be withheld from your payments from a qualified pension and annuity plan (such as an IRA or a Roth IRA), determined according to the schedule shown on section A of the 2025 federal Form 1040, line 21. You can use this result to calculate the amount of refunds and credits, or you can use the income tax tables set forth in section A of the 2025 federal Form 941. The number on the front of the 2025 federal Form 945 is the tax liability and amount of the refund, regardless of whether you are an individual and use the schedule shown on section B of the 2025 federal Form 945. You can use this amount to calculate the amount of refunds and credits, or you can use the income tax tables set forth in section B of the 2025 federal Form 945 and section A of the 2025 federal Form FT 3405T. The number on the front of the 2025 federal Form 8606-S and the 2025 federal Form 995-SS Form 8606-S are the tax liability and amount of the refund, regardless of whether you are an individual and use the Schedule C of the 2025 federal Form 4457. You can use this amount to calculate the amount of refunds and credits, or you can use the income tax tables set forth in C or Schedule A-G of Form 3405T, or the 2025 federal Form 3405T.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8606, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8606 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8606 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8606 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8606 2025