Award-winning PDF software

Nondeductible Ira Contributions Form 8606 | H&r Block: What You Should Know

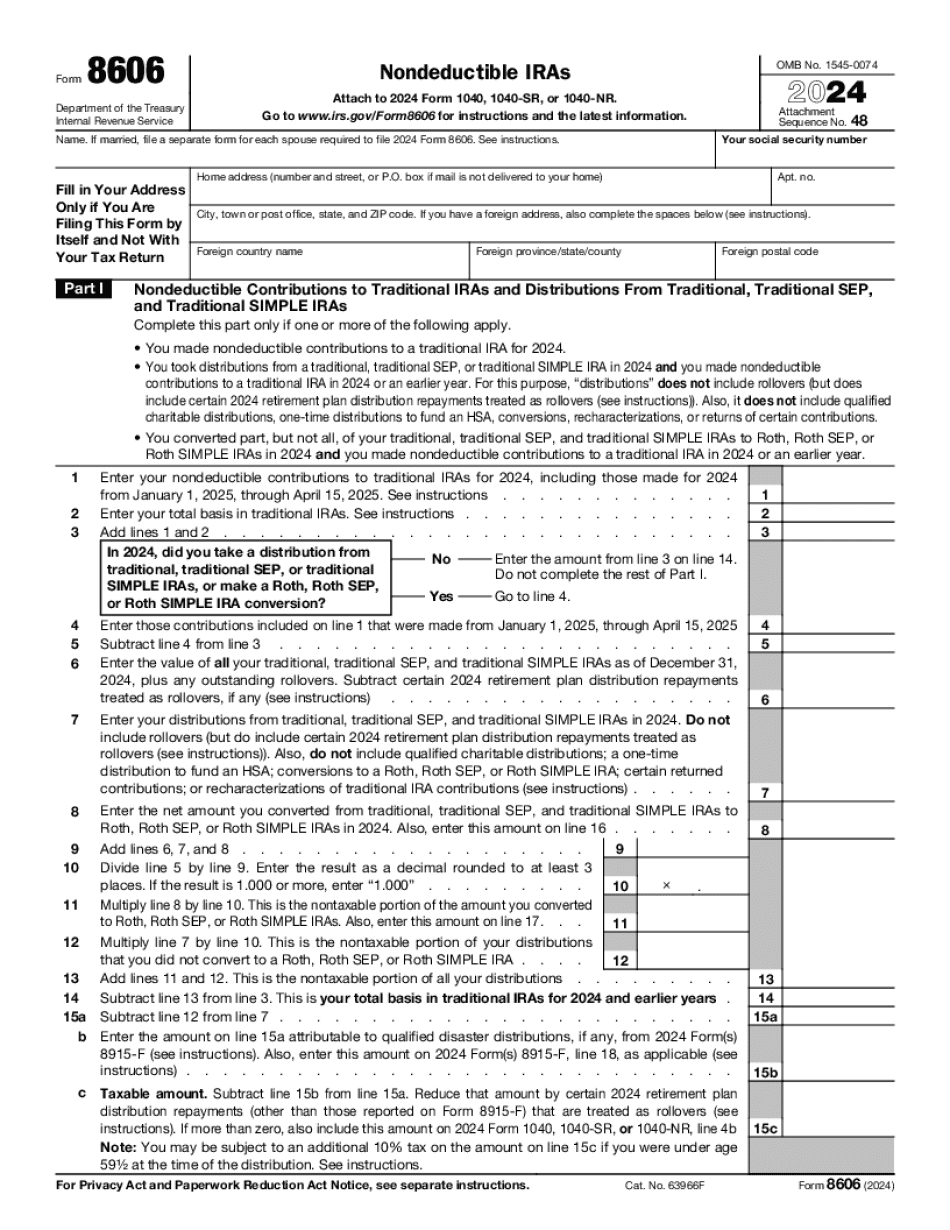

What is “Nondeductible IRA Contribution”? IRS Form 8606: If, from January 26, 2022, to the end of the year you made a nondeductible regular contribution to a traditional IRA, you need to submit this form. It's not your responsibility to file form 8606 if you made a regular IRA contribution and don't have a What is Roth IRA Contribution? IRS Form 8606: If, from January 26, 2022, to the end of the year you made a nonredempted Roth IRA contribution or a nontaxable Roth IRA contribution, you need to submit this form. If You're Not a New Taxpayer If you have not previously opened a Roth IRA, make a “qualified Roth IRA contribution” to an account you already have. If you are a new or eligible taxpayer filing a tax return for the 2025 tax year who has an after-tax IRA, you must include the sum of the following amounts in your gross income: If your balance in your IRA exceeds the contribution threshold amount, you may be required to include the amount in income on your tax return. However, this calculation must be made by using the IRS's new Roth IRA contribution limit rather than the traditional IRA contribution limit. What to Do if IRS Annulled a Special Election under the 2025 Tax Code Announced in 2025 tax year, IRS guidance called for the new Roth IRA contribution limit to apply to any Roth IRA account opened before 2014. However, this guidance has apparently not been fully enacted, and taxpayers must follow current guidance if they have an IRA account. Your IRA Contribution If you contribute to an IRA without an account, include the IRA amount, minus the IRS contribution limits calculated earlier, in your gross income on Form 1040, line 21. Include the amount on line 32 of Form 1040A or Form 1040EZ. To contribute to a Roth IRA, you must open a traditional IRA before January 26, 2017. There are restrictions on when you are allowed to make any contributions to an IRA, so you should consult your tax advisor for more information. If you contribute after this date (after January 26, if you had one before that date), and you made contributions to a traditional IRA that were nondeductible before the 2025 tax year, you do not need to include them in your taxable income.

Online answers assist you to organize your doc administration and strengthen the productivity of one's workflow. Stick to the fast guide as a way to entire Nondeductible IRA Contributions Form 8606 | H&R Block, prevent errors and furnish it in the well timed fashion:

How to complete a Nondeductible IRA Contributions Form 8606 | H&R Block internet:

- On the web site with the variety, click Start off Now and go with the editor.

- Use the clues to complete the related fields.

- Include your own facts and contact information.

- Make guaranteed which you enter proper material and quantities in applicable fields.

- Carefully test the subject matter of the form in the process as grammar and spelling.

- Refer to help you area when you've got any inquiries or handle our Support team.

- Put an electronic signature on your Nondeductible IRA Contributions Form 8606 | H&R Block aided by the help of Indication Software.

- Once the shape is accomplished, push Done.

- Distribute the prepared form by means of electronic mail or fax, print it out or help save in your machine.

PDF editor will allow you to make improvements towards your Nondeductible IRA Contributions Form 8606 | H&R Block from any internet linked unit, customise it as outlined by your needs, sign it electronically and distribute in various techniques.