However, if you need to fill it out this tax forms is the exact form you would

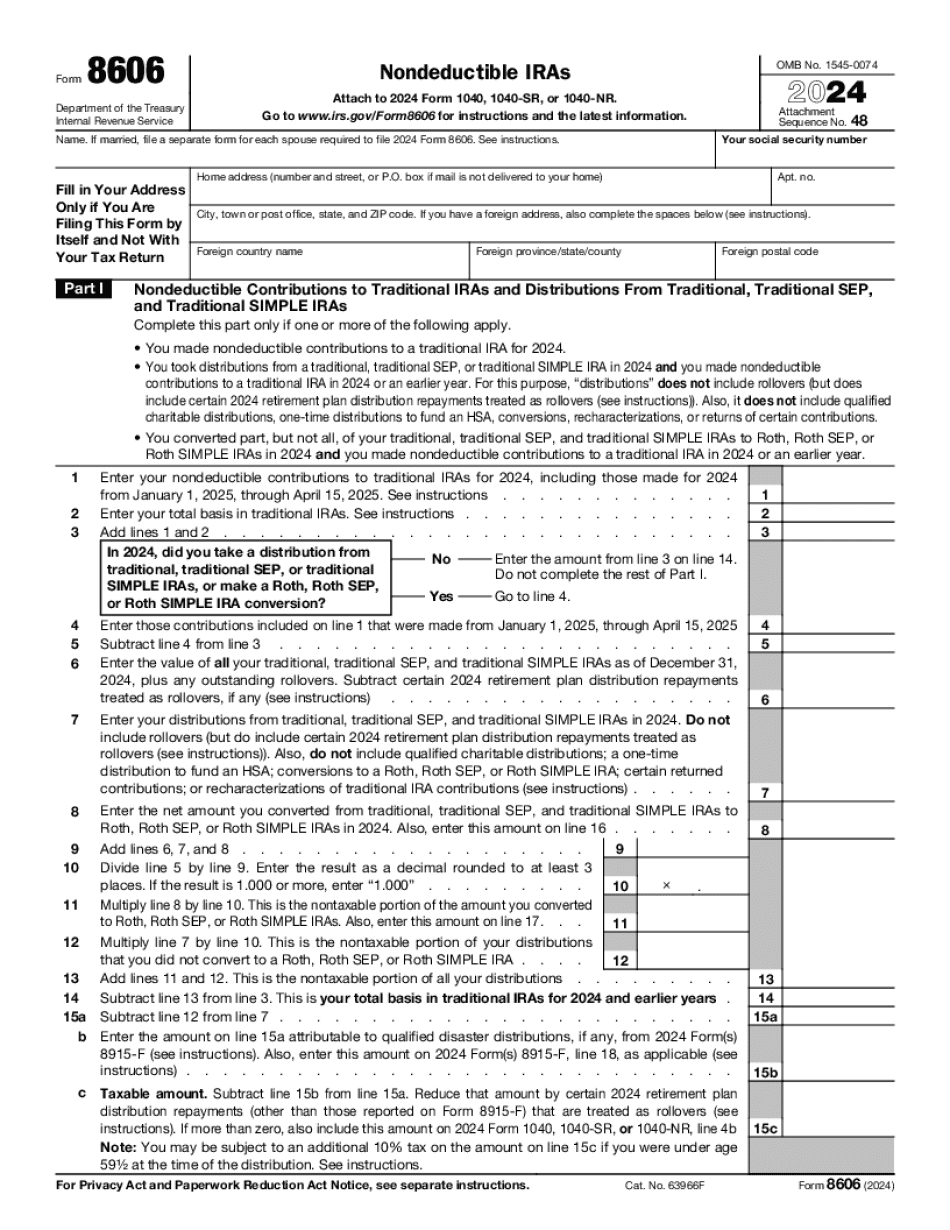

Forms of IRAs? This Guide. A Form 8606 is just one of several forms that you can get from your government. The IRS also provides IRAs in many other different forms. When looking at the form you would notice that they are very short and simple. However, if you need to fill it out this tax forms is the exact form you would fill out. Form 8606 is for all taxpayers whether you have: An IRA or 401k A retirement plan A defined contribution plan (DCP) A SEP-IRA An 403(b) If you hold an IRA this form is for you. If you have a retirement plan or a 401k these are some specific forms you would get. If you have a tax return that you need to file within the upcoming year you will need to check with your accountant about which form you will need. The IRS and your accountant will help you find what form applies. It's a good idea to have it on hand and know what to use from the start. Now to start filing. For 2018: It's a good idea to use Form 8606 because it simplifies things and also has an easy-to-understand format. In other words, you don't have to remember to change your answers, so you can save time later. If you think you need to complete a tax form this is the right place. You Don't Need to File a Filing Claim with the IRS For Form 8606 a few things need to be aware about. In the past filing a Form 8606 filing a claim has always been required. The tax code allows you to file Form 8606, but you do not need to file a form claim, however in 2017/2018 Form 8606 is no.

Nondeductible IRA distributions or contributions made directly to an

Nondeductible IRA distributions or contributions made directly to an individual's retirement plan may be considered nontaxable in the year paid, in whole or in part (as explained below). In general, distributions from a Roth IRA (including rollover contributions) are not deductible. Generally, if you take distributions directly from your Roth IRA within the year, you may deduct the entire amount as a qualified deduction in your income tax year in which you received the distribution. Distributions made directly to you from a non-Roth IRA are considered nondeductible. However, if you receive a nontaxable contribution to it from a third party, you may deduct the contribution to your non-Roth IRA. You must report this nondeductible distribution on IRS Form 1099-R and Schedule D. Direct rollovers of your retirement plan to or from your Roth IRA qualify as nondeductible retirement contributions, up to the limit of 2,500 for 2017. If you have other types of rollovers of your retirement plan to or from other tax-sheltered accounts that are considered nondeductible, report all amounts by including them on your taxable income tax return for the year you received the distribution. An individual can make nontaxable, nondeductible contributions to a Roth IRA and rollover them to a traditional IRA. If the total contribution to a non-Roth Roth IRA exceeds 2,500/6,500 for 2017, the contribution is treated as an eligible rollover contribution and may be rolled over to a qualified.

— Financial-Education.com (Financial_Education) August 6, 2016 Is

Com (IRAS_com) August 6, 2016 What does it cost to invest in your IRA? — Financial-Education.com (Financial_Education) August 6, 2016 Is retirement plan tax-advantaged? — Investing.com (investing) August 6, 2016 Which 401(k) account is right for me? You've heard it all before. Check out our latest post, 401k vs. 401(k) Matching Benefits vs. Matching Contributions, to get all the details. A lot to take in. Let's break it down a few ways: Your 401(k) is an investment account — The 401(k) is a fund of funds (investment), where, after fees, you can put money directly from one source to another by making a withdrawal, with the potential to earn income from those investments. Your IRA is an investment account — The IRA is a plan where people can make their own investments. Taxes on investment income — Investment income that isn't taxed is referred to as a regular annuity. Regular annuities typically pay a tax rate of around 0.5%. The government does not tax your earnings as income, meaning it's free money to you. That means the money isn't subject to tax. Taxes on savings income — People who qualify for an early withdrawal of their 401(k) can take up to 55,000. In most instances, that income will be taxed at ordinary income rates. (See also: How Does Retirement Savings Work in the US?) Taxes on retirement plan withdrawals — The tax rate on your pre-tax 401(k) withdrawals is the regular tax rate for that withdrawal.

How can I fix it and make my 8606 tax smart as well as my home. My goal is to

I have a 6606 as it is now, and it needs an update. How can I fix it and make my 8606 tax smart as well as my home. My goal is to get all three back to a single form that doesn't have to be filed and doesn't have to be filed in Memphis. (And that should cost me 200 in return for a tax savings of 3% or so). My plan is to start by just making the tax adjustment. Then I will get the Form 8606 corrected. And then I will start working on the other forms. And I will do a write-up as soon as I have those in front of me. I have some ideas on what I will do to the home. But I will wait and see what others do with them. We know there are two forms: 1065 and 8606. I know I will have to file the form 1065. After I filed the 8606 I will file the Form 8606 again to get my 1065. Let me know your thoughts if anyone has thoughts on this Jeff L. What if I don't have any changes that need fixing on my 8606? In that case, you should go ahead and fix the tax problem. For example, do you have any new home improvements that don't need to be added to your property's property code, or you just need to change your deed? You should fix that to make the tax situation in the future work for you, including adding the adjustments. Do you have the correct address on line 6 of Form 8606? Or if the address is wrong on line 10, do you need to correct it? Do you need to use the new or new-looking address line 6? Do you need to make any other changes to avoid paying the tax? Do you have enough cash to cover.

Award-winning PDF software